Hi there. If you want to grow your money, you need good stocks. At 5StarsStocks.com, we make it simple. We find the best dividend, income, and value stocks for you. Our goal? Help you build a strong portfolio that lasts.

We know the stock market can feel hard. That’s why we share clear info. No big words. Just facts and tips. Let’s see how we can help you win in 2026.

Contents

What is 5StarsStocks.com?

We are a free spot for stock info. We focus on high-quality picks. Think stocks that pay you back and grow over time.

Our team looks at company basics. We check cash flow, debt, and more. We cover all types: growth, value, dividend, and income. We also talk about sectors like tech, energy, and health.

Unlike other sites, we keep it real. No hype. Just tools to help you decide.

How We Help You Invest Better

We give you what you need to succeed. Here’s how:

- Stock Picks: We list top choices each month. For example, we like firms with steady payouts.

- Guides: Learn value investing in five steps. Or how to read charts.

- Risk Tips: Know when to sell. Set stops to protect your cash.

- Market News: We cover trends like AI and green energy.

We empower you. You get the facts. Then you pick what fits your goals.

Top Stock Picks for January 2026

The market changes fast. In 2026, we see growth in AI, health, and energy. Rates may drop, which helps value stocks.

Here are our top picks. We chose them for strong basics and good yields. These beat old lists from 2024.

| Stock Name | Ticker | Category | Dividend Yield | Why Buy Now |

|---|---|---|---|---|

| Visa | V | Dividend | 0.8% | Leads in payments. Grows fast with online shopping. Safe pick for income. |

| Coca-Cola | KO | Income | 3.1% | Steady sales in all markets. Raises dividend each year. Great for beginners. |

| ExxonMobil | XOM | Value | 3.5% | Strong in energy. Low debt. Benefits from oil demand. |

| Nvidia | NVDA | Growth/Value | 0.1% | Tops AI chips. Huge sales jump expected in 2026. |

| Amazon | AMZN | Value | N/A | E-commerce king. Adds AI tools. Trades at fair price. |

| Bristol-Myers Squibb | BMY | Dividend | 4.2% | Health leader. New drugs coming. High yield for income. |

| Enterprise Products Partners | EPD | Income | 6.8% | Pipelines pay well. Stable cash from energy transport. |

| Meta Platforms | META | Value | 0.5% | Social media growth. AI ads boost earnings. |

| Realty Income | O | Income | 5.2% | Real estate trusts. Monthly payouts. Safe for rent-like income. |

| Taiwan Semiconductor | TSM | Value | 1.4% | Makes chips for all. Key for tech boom in 2026. |

These picks come from fresh data. We looked at earnings growth and low risks. Start with one or two that match your style.

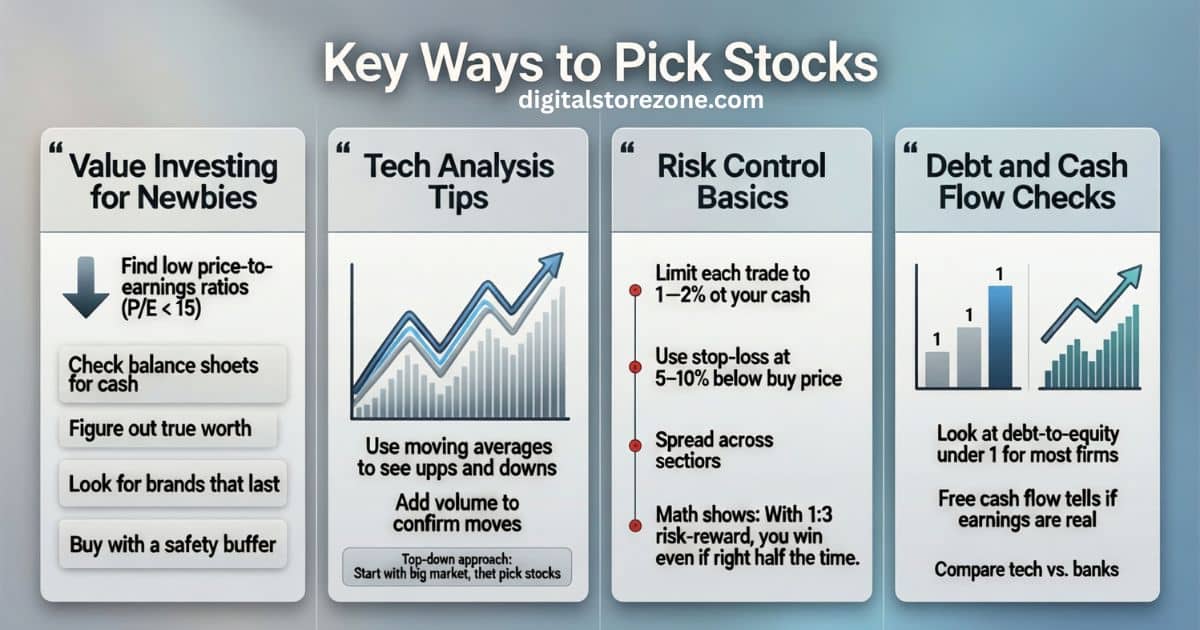

Key Ways to Pick Stocks

We cover all the basics from our site. But we add more depth here.

Value Investing for Newbies

Value means buy cheap, strong firms. Follow these steps:

- Find low price-to-earnings ratios.

- Check balance sheets for cash.

- Figure out true worth.

- Look for brands that last.

- Buy with a safety buffer.

For example, use P/E under 15 for good deals.

Tech Analysis Tips

Charts help spot trends. Use moving averages to see ups and downs. Add volume to confirm moves.

We teach top-down: Start with big market, then pick stocks.

Risk Control Basics

Don’t lose big. Set rules:

- Limit each trade to 1-2% of your cash.

- Use stop-loss at 5-10% below buy price.

- Spread across sectors.

Math shows: With 1:3 risk-reward, you win even if right half the time.

Debt and Cash Flow Checks

Look at debt-to-equity under 1 for most firms. Free cash flow tells if earnings are real.

We explain with examples like tech vs. banks.

2026 Market Outlook: What to Watch

This is new for you. In 2026, expect AI to lead. Rate cuts help banks and real estate.

Energy stays strong with green shifts. Health stocks rise with new tech.

Watch for:

- AI growth: Firms like Nvidia and Meta.

- Rate drops: Boosts value picks like utilities.

- Global trade: Helps firms like Visa.

Stay ahead. We update this each quarter.

Build Your First Portfolio: Step-by-Step

We add this guide to make it easy. Competitors skip it.

- Set goals: Want income? Pick dividends.

- Open an account: Use a free broker.

- Pick 5-10 stocks: Mix types from our table.

- Buy small: Start with $100 per stock.

- Check monthly: Sell if basics change.

- Add cash over time: Grow slow.

This way, you build wealth without stress.

Common Mistakes and How to Fix Them

Many fail here. We help you avoid:

- Chasing hot tips: Stick to facts.

- Too much debt: Pick low-leverage firms.

- Ignore fees: Use low-cost funds if new.

- Sell too soon: Hold good stocks long.

- No plan: Always have rules.

Fix with our templates. Print and follow.

About Us at 5StarsStocks.com

We started to help real people. Our team has years in finance. We share free reports and picks.

Join our list for updates. We cover all: From penny stocks to blue chips.

Our Main Topics

We group info for easy finds:

- Firm Basics: Statements and ratios.

- Chart Tools: RSI and trends.

- Risk Ways: Stops and size.

- Stock Types: Growth, value, income.

- Sectors: Tech, energy, health.

Dive in. Each has guides and examples.

Cinclusion

You now have everything you need. Clear stock picks. Simple steps. Strong tips to avoid mistakes.At 5StarsStocks.com, we keep it free and easy. Our top dividend, income, and value stocks can help you grow your money the smart way.Start small today. Pick one or two from our list. Add more over time. Watch your portfolio grow.Join thousands of smart investors who use our guides. Get fresh picks each month. Take control of your future.

Head over to 5StarsStocks.com now. Your best investing year starts here. Let’s make 2026 your most profitable one yet!

FAQs

We expand these. Competitors have none.

What makes a 5-star stock? It’s strong basics, good growth, and fair price. Like our picks above.

How do I start with no money? Save small. Use apps for fractional shares.

Are dividends safe in 2026? Yes, for strong firms. But watch economy.

What’s better: Value or growth? Mix both. Value for cheap, growth for speed.

How often do you update picks? Monthly. Check our site.

Can I trust free info? We use real data. No bias.

What if market crashes? Hold cash buffer. Buy low.

Do you cover crypto? Yes, in sectors. But focus on stocks.

How to calculate yield? Dividend divided by price. Easy math.

Is AI changing stocks? Yes. We pick AI leaders like Nvidia.