Navigating the volatile world of cryptocurrency requires the right set of tools. Traders rely on technology to make informed decisions.

The digital currency market moves quickly. Crypto trading tools help keep pace with its rapid changes. These instruments range from market analysis software to portfolio trackers. They are crucial for both novice and seasoned traders. The right tool can differentiate between a profitable trade and a missed opportunity.

As crypto trading grows, so does the arsenal of tools available. Each tool serves a unique purpose in a trader’s toolkit. Some offer real-time data, while others track trends or manage assets. They aim to simplify the complexities of the market. Understanding these tools is key to successful trading. Our guide will explore various crypto trading tools. We will discuss what they do and how they can benefit your trading strategy. Let’s dive into the digital toolbox that can enhance your trading experience.

Contents

Essential Tools For Crypto Trading

Entering the world of cryptocurrency can be like venturing into a vast ocean of data and market moves. To navigate these waters successfully, Essential Tools for Crypto Trading becomes your compass and map. These tools equip traders with the right information, help manage assets efficiently, and enable better decision-making. Whether you are a beginner or a seasoned trader, understanding and utilizing these tools is pivotal to your success in the crypto market.

Types Of Trading Tools

There are various trading tools that cater to different aspects of the cryptocurrency market. Here’s a look at some essential categories:

- Trading Signals – These are recommendations generated by analysis to help traders decide when to buy or sell a cryptocurrency.

- Market Indicators – These provide insights into market trends and can be fundamental or technical, such as moving averages or RSI.

- Price Prediction Tools – They analyze market data to forecast future price movements.

- Risk Management Tools – Essential for setting stop-loss orders and managing trade risks effectively.

Additionally, traders leverage:

| Tool Type | Description |

|---|---|

| Cryptocurrency Analysis Tools | For deep dives into market data and crypto assets’ performance. |

| Technical Analysis Software | Enables detailed chart analysis for better trade decisions. |

| Automated Trading Systems | Allows setting rules for automatic trade execution. |

| Portfolio Management Tools | Helps track and manage your investment portfolio’s health. |

| Trading Bots | Automates trading based on preset criteria to capitalize on market opportunities 24/7. |

Lastly, Crypto Trading Software encompasses a range of functionalities, including market tracking, backtesting strategies, and real-time trading across multiple exchanges.

Benefits Of Using Tools

The benefits of using these tools in crypto trading are numerous:

- They help in making informed decisions by providing real-time data and analysis.

- Tools like Automated Trading Systems and Trading Bots save time and can trade around the clock, so you don’t miss opportunities.

- Risk Management Tools protect your capital by preventing significant losses.

Effective use of these tools can lead to:

- Improved accuracy in trades.

- Better control over investment portfolios.

- Enhanced ability to predict market movements.

With Portfolio Management Tools, traders can see their holdings at a glance, making it easier to make swift changes. Technical Analysis Software empowers traders to spot trends and patterns that may not be obvious at first glance. Meanwhile, Market Indicators and Price Prediction Tools offer a broader understanding of market dynamics, giving traders the upper hand in a volatile environment.

In summary, trading tools are not just helpful but essential for any trader looking to succeed in the fast-paced world of cryptocurrency trading. They bring clarity to complexity and provide a strategic edge in a market where every second counts.

Charting Software

Navigating the volatile waters of cryptocurrency trading demands not just nerves of steel but also the right tools. At the heart of these tools lies Charting Software, a fundamental resource for any trader. This software provides visual representations of market data, helping traders to spot crypto market trends and make informed decisions. A robust charting tool is as vital as the air for a diver; without it, one is simply guessing in an ocean of numbers.

Popular Charting Platforms

Cryptocurrency traders have a wealth of charting platforms to choose from, each offering a unique set of tools to enhance trading strategies. Here are some of the most recognized names in the space:

- TradingView: Known for its vast array of trading indicators and collaborative features.

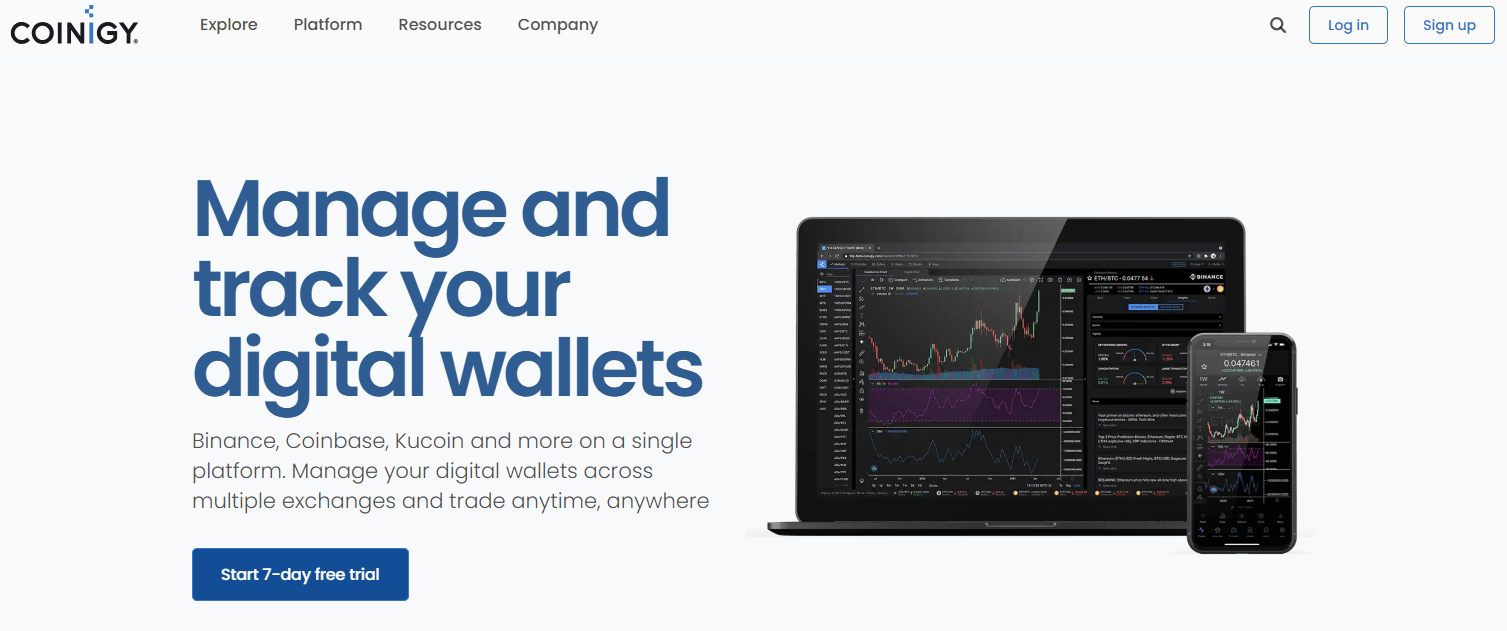

- Coinigy: Offers a comprehensive digital dashboard for trading across multiple exchanges.

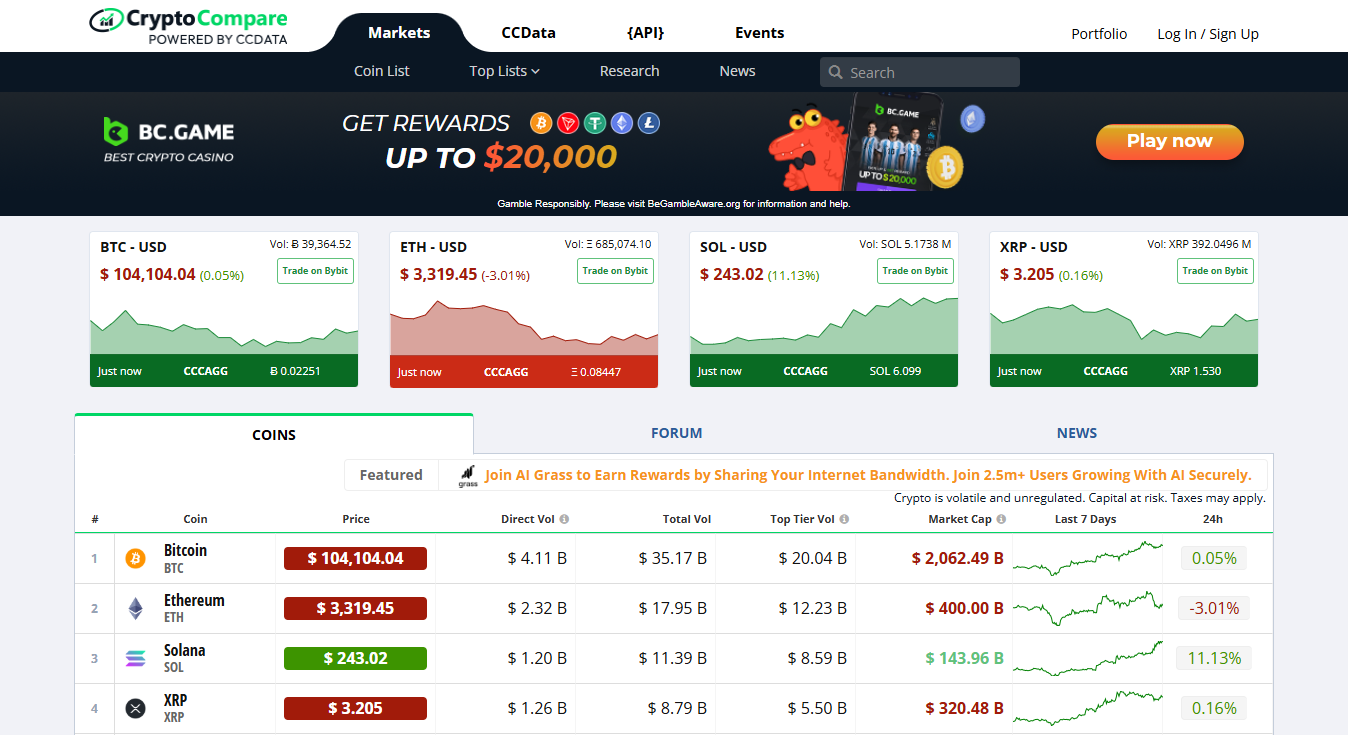

- CryptoCompare: Provides a simple interface with access to historical data and current prices.

These platforms cater to both novice and seasoned traders, offering a blend of user-friendly interfaces and advanced features. Let’s visualize their offerings in a table format:

| Platform | Key Features | User Level |

|---|---|---|

| TradingView | Community scripts, Multi-timeframe analysis | Beginner to Expert |

| Coinigy | Portfolio management, High-definition charting | Intermediate to Expert |

| CryptoCompare | Price tracking, Forum discussions | Beginner to Intermediate |

Selecting the right platform often depends on personal trading style and the need for specific features like Real-Time Data Feeds or Automated Trading Systems.

Key Features To Look For

When choosing charting software, certain features stand out as must-haves for effective trading. Here’s a list of what to keep an eye on:

- Technical Analysis Tools: Essential for analyzing price movements and market trends.

- Real-Time Data: Up-to-the-minute price information is crucial for timely decisions.

- Customizable Indicators: Personalizing indicators can fine-tune analysis.

- Backtesting Capabilities: Testing strategies against past data helps improve them.

- Portfolio Management: Integrating with Portfolio Management Software to track investments.

In addition to these, services like Trading Signal Services and Cryptocurrency Analytics play a significant role. They provide insights that are not immediately obvious from raw data alone. More advanced traders might also look for features that support Automated Trading Systems, allowing them to execute trades automatically based on predefined criteria. Ultimately, a platform that balances Market Analysis Tools with ease of use will serve traders best.

Remember, the goal is not just to track the crypto markets but to understand them. A well-chosen charting software can be your best ally, turning data into actionable insights and helping to predict the next big move.

Trading Bots

Let’s talk about trading in the crypto world. It’s fast. It’s 24/7. It’s a lot to keep up with. Enter trading bots. These bots help by trading for you. Think of them as your personal trading assistants. They work all day and night, making decisions based on rules you set. Pretty handy, right? Let’s dive deeper into how these bots work and some of the top bots you can use.

Credit: cwallet.com

How Trading Bots Work

Understanding how trading bots work is key. They’re not magic. They follow the specific instructions you give them. Here’s a simple breakdown:

- Set up: First, you choose a bot and set it up. This means telling the bot what to do. For example, when to buy or sell.

- Rules: You create rules. These can be simple or complex. Rules are based on market conditions, price movements, or time.

- Execution: The bot watches the market. It follows your rules. When conditions match your rules, the bot makes a trade.

- Monitoring: Even after setting up, you keep an eye on the bot. You might adjust rules as the market changes.

It’s like having a robot friend who trades for you. But remember, a bot is only as good as its rules. So, setting them upright is crucial.

Top Trading Bots Available

Now, let’s talk about some top trading bots. There are many, but we’ll focus on a few popular ones. Here’s a quick overview:

| Bot Name | Key Feature | Price |

|---|---|---|

| Bot A | Easy to use | $10/month |

| Bot B | Advanced strategies | $20/month |

| Bot C | Good for beginners | Free |

Each bot has its strengths. Bot A is great if you want something simple. Bot B offers more complex options. And Bot C is perfect if you’re just starting out. Remember, the best bot for you depends on your needs and trading style.

Before choosing a bot, think about what you want. Consider your trading strategy, budget, and experience level. Then, test a few bots. Most offer a trial period. This way, you can find the perfect bot for your trading journey.

Credit: plasbit.com

Portfolio Trackers

In the fast-paced world of cryptocurrencies, staying informed about your investments is crucial. This is where Portfolio Trackers come into play. They offer real-time insights into your digital assets, allowing you to make informed decisions. These tools integrate features like Blockchain Analytics, Crypto Market Analysis, and Investment Performance Metrics to provide a comprehensive view of your crypto holdings. Whether you’re a seasoned trader or new to the crypto space, having a robust portfolio tracker can be the difference between thriving and just surviving in the market.

Importance Of Tracking

Understanding the importance of tracking your cryptocurrency investments cannot be overstated. It’s not just about watching numbers go up and down. It’s about making smart, informed decisions. Here’s why tracking is essential:

- Performance Analysis: Portfolio trackers provide critical Investment Performance Metrics that show how your investments are doing over time.

- Market Position: Knowing where you stand against the market enables you to adjust your strategies accordingly.

- Alerts: With Price Alert Applications, you’re always in the know about significant price changes and can act swiftly.

Moreover, in the realm of Crypto Exchange Tools and Automated Trading Bots, portfolio trackers help you maintain control over your automated strategies, ensuring they align with your financial goals. They also play a pivotal role in Market Sentiment Analysis, giving you a peek into the current mood of the crypto market. This information is invaluable when deciding to buy or sell.

Here’s a simple breakdown of how portfolio trackers can enhance your crypto trading experience:

| Feature | Benefit |

|---|---|

| Real-Time Data | Make timely decisions based on the latest market activity. |

| Diverse Asset Tracking | Manage a variety of digital currencies and assets in one place. |

| Automated Alerts | Stay updated with automated notifications for price movements. |

Best Portfolio Tracker Apps

Choosing the best portfolio tracker app can significantly impact your Cryptocurrency Portfolio Management. The market offers a variety of apps, each with unique features tailored to different trading needs. Here are some aspects to look for in a top-tier portfolio tracker:

- User Interface: A clean, intuitive interface helps you navigate your portfolio with ease.

- Supported Exchanges: The app should support a wide range of crypto exchanges for seamless tracking.

- Security: Strong security features protect your sensitive financial data.

Additionally, the best trackers integrate Trading Signal Tools to guide your trading decisions. They also sync with Blockchain Analytics for a deeper dive into the data behind your assets. Below is a list of popular portfolio tracker apps designed to keep you ahead in the crypto trading game:

| App Name | Key Features |

|---|---|

| App A | Real-time analytics, Automated trading, Secure asset management |

| App B | Extensive exchange support, Interactive charts, Price alerts |

| App C | Market sentiment analysis, Portfolio diversification, Tax Reporting |

Remember, the right portfolio tracker aligns with your investment strategies and helps you stay on top of your crypto game. Choose wisely to keep your digital assets in check and your peace of mind intact.

Market Analysis Tools

Trading in the fast-paced world of cryptocurrency requires sharp tools to stay ahead. Market Analysis Tools are essential for traders aiming to make informed decisions. These tools break down complex market data, offering insights into market trends and potential investment moves. Understanding how to leverage these tools can greatly enhance your trading strategy. Let’s explore the most vital types of analysis tools that can aid you in navigating the crypto markets effectively.

Fundamental Analysis Tools

Fundamental Analysis Tools dive deep into the core of market dynamics. They help traders evaluate a cryptocurrency’s intrinsic value by analyzing various economic and financial factors. Here are some key aspects these tools focus on:

- Project Whitepapers: Insightful documents that outline the purpose and technology behind a cryptocurrency.

- Team and Developer Activity: Reports on the experience of the team and their development progress.

- Community Engagement: Metrics on how active the community is are often a sign of the project’s health.

- News and Event Updates: Real-time alerts on events that could impact prices.

These tools sift through vast amounts of data to present a clear picture of a coin’s potential. A table summarizing the key metrics evaluated by these tools is shown below:

| Metric | Description |

|---|---|

| Market Capitalization | The total value of all coins in circulation. |

| Volume | Amount of coins traded within a certain time frame. |

| Regulatory News | Updates on legal changes affecting the crypto space. |

By using Fundamental Analysis Tools, traders can gauge a cryptocurrency’s strength beyond just its current price.

Technical Analysis Tools

Technical Analysis Tools are the chart wizards of crypto trading. They turn price and volume data into patterns and trends that can signal where the market might head next. Here’s a look at some components of technical analysis:

- Candlestick Charts: Visual representations of price movements over time.

- Indicators and Oscillators: Math-based tools that aid in predicting future market behavior.

- Support and Resistance Levels: Key price points where the market tends to change direction.

- Moving Averages: Lines that smooth out price data to show a trend over a specified period.

For example, a popular indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements. A simple breakdown of the RSI is given in the table below:

| RSI Value | Market Condition Indicated |

|---|---|

| Below 30 | Potentially Oversold |

| 30-70 | Normal Range |

| Above 70 | Potentially Overbought |

Traders use these tools to spot entry and exit points, making data-driven decisions to manage risks and seize opportunities.

Credit: www.businessworldit.com

Risk Management Tools

Trading in the crypto world can be thrilling. Yet, it’s not without its risks. This is where Risk Management Tools come into play. They help traders make smarter decisions. Tools like Exchange APIs, Volatility Assessment Tools, Trading Indicators, and Cryptocurrency Trading Software are vital. They work together to reduce risks. Trading Signal Services, Automated Trading Bots, Market Analysis Platforms, Portfolio Management Tools, and Crypto Charting Software also play a big role. Let’s dive into some key tools that help manage risk: Stop-Loss Strategies and Position Sizing Tools.

Stop-loss Strategies

Stop-loss strategies are crucial for crypto traders. They help limit potential losses. A stop-loss is a set price at which your trade will automatically close. This way, you won’t lose more than you’re willing to. Here’s why they’re important:

- Protects capital – It keeps your money safe from big losses.

- Controls emotions – It takes the decision out of your hands. This means less stress.

Using Exchange APIs and Automated Trading Bots can help set stop-losses efficiently. These tools use Trading Indicators and Market Analysis Platforms to find the best stop-loss points. Here’s a simple table showing how different tools help in applying stop-loss strategies:

| Tool | Function |

|---|---|

| Exchange APIs | Automates stop-loss orders |

| Automated Trading Bots | Uses market data to set stop-losses |

| Trading Indicators | Helps identify stop-loss points |

This shows how integrating various tools can secure your trades.

Credit: quadcode.com

Position Sizing Tools

Position sizing is about how much to invest in a trade. It’s key to managing risk. The right tools can help you decide how much to put into each trade. This ensures you don’t risk too much on one go. Here’s what good position sizing can do:

- Limits risk – It helps you not to put all your eggs in one basket.

- Balances portfolio – It keeps your portfolio diverse and healthy.

Portfolio Management Tools and Volatility Assessment Tools are great for this. They look at the market’s ups and downs. Then, they tell you how much to invest. Cryptocurrency Trading Software also plays a part. It can automate the calculation based on your risk preference. See the table below for a quick overview:

| Tool | Function |

|---|---|

| Portfolio Management Tools | Helps diversify investments |

| Volatility Assessment Tools | Assesses risk level of assets |

| Cryptocurrency Trading Software | Automates position sizing |

These tools together make sure you’re investing the right amount. They keep your money safe while you explore the crypto market.

News Aggregators

In the dynamic world of cryptocurrency trading, staying informed is key to success. News aggregators serve as powerful tools for traders. They compile the latest updates from various sources into one easy-to-access location. This ensures traders can make swift, informed decisions based on current market trends and events.

Real-time News Sources

For traders in the crypto space, real-time news sources are essential. They provide the latest information as it happens, which is crucial in a market known for its volatility. Below are key features of real-time news sources that traders rely on:

- Speed: The faster you get the news, the better your chances to act on it.

- Accuracy: Reliable news means making informed decisions.

- Diversity: Multiple sources offer a wider perspective on market conditions.

Take a look at how these features benefit traders:

| Feature | Benefit to Trader |

|---|---|

| Speed | Early market entry or exit |

| Accuracy | Trustworthy analysis and strategy |

| Diversity | A balanced view of market sentiment |

Real-time news sources come from various platforms, including social media, news websites, and dedicated crypto news applications. They allow traders to stay on top of events like regulatory changes, tech upgrades, or economic indicators that can affect the crypto market.

Impact Of News On Trading

News can significantly impact trading decisions and the cryptocurrency market as a whole. Here’s a glimpse at the power of news in crypto trading:

- Market Sentiment: Positive news can boost confidence, while negative news can cause panic.

- Price Volatility: News can trigger quick price changes, creating opportunities and risks.

- Strategic Trading: News helps in planning trades around expected market movements.

Understanding the impact of news on trading:

| Type of News | Possible Trader Reaction |

|---|---|

| Regulatory Announcements | Reassess risk and portfolio distribution |

| Breakthrough Technology | Consider investing in innovative projects |

| Economic Events | Adjust strategies to hedge or capitalize on trends |

Traders must assess news for its potential impact on the market. A single piece of news can change the market direction within minutes. Therefore, integrating news into trading strategies is critical for maximizing gains and minimizing losses. News aggregators play a pivotal role in this process by delivering curated news to traders swiftly and effectively.

Credit: coinsutra.com

Tax Calculation Tools

Navigating the complex world of cryptocurrency can be challenging, especially when it comes to taxes. Crypto traders have to stay on top of their game, not just in reading market trends but also in managing their tax obligations. Tax calculation tools have become essential for anyone involved in crypto trading. These tools are designed to simplify the process of calculating taxes, ensuring traders can focus on what they do best: trading. Let’s dive into the importance of tax compliance and explore some top tax tools that can help traders during tax season.

Importance Of Tax Compliance

Tax compliance is critical for all crypto traders. It’s not just about following rules; it’s about protecting your investments and staying clear of legal issues. Here’s why it matters:

- Regulatory Requirements: Many countries require traders to report their crypto transactions for tax purposes. Non-compliance can lead to heavy fines or even legal action.

- Capital Gains Reporting: Selling digital assets can result in capital gains or losses. Accurate reporting is a must to determine your tax liability correctly.

- Trading Tax Reporting: Every trade can be a taxable event. Tax calculation tools help track these events and report them correctly.

- Organized Records: Crypto Portfolio Trackers and Cryptocurrency Accounting Tools keep your transaction history organized, making it easier to file taxes.

Blockchain Tax Software and Cryptocurrency Tax Calculators are integral Tax Compliance Solutions. They automatically sync with your trading platforms, pulling transaction data to keep you compliant. See the table below for a quick overview of why tax compliance is essential.

| Reason | Explanation |

|---|---|

| Legal Obligation | Fulfilling tax obligations avoids penalties. |

| Accuracy in Reporting | Ensures correct payment of taxes. |

| Financial Planning | Aids in better management of potential tax impacts on returns. |

| Peace of Mind | Knowing you are compliant reduces stress. |

Top Tax Tools For Traders

With the rise of digital currencies, a variety of tools have emerged to assist with trading analytics and tax reporting. Here are some of the Top Tax Tools for Traders:

- Crypto Trading Software: Offers a complete view of your trading activities and potential tax liabilities.

- Digital Asset Management: Keeps track of your assets across various exchanges and wallets for a comprehensive financial picture.

- Trading Analytics Tools: Provide insights into your trades, helping you make informed decisions and calculate your taxes with precision.

Let’s consider a few popular tax tools that have gained traction among crypto traders:

| Tool | Features |

|---|---|

| CoinTracker | Tracks your portfolio and calculates taxes. |

| TokenTax | Offers a range of services from tax calculation to filing. |

| CryptoTrader.Tax | Integrates with major exchanges and provides detailed tax reports. |

Using these tools, traders can automate the process of tax calculation, saving time and ensuring accuracy. Remember, tax laws can change, and staying compliant is crucial. These tools stay updated with the latest regulations, offering peace of mind and letting traders focus on market opportunities.

Frequently Asked Questions

What Are Essential Crypto Trading Tools?

Essential crypto trading tools include charting platforms, crypto wallets, portfolio trackers, and news aggregators. These tools help traders analyze trends, secure assets, monitor investments, and stay updated with market news.

How Do Trading Bots Optimize Crypto Strategies?

Trading bots automate crypto trading strategies, executing trades faster than humans. They work 24/7, follow set algorithms, and can adjust to market conditions in real-time to optimize trading outcomes.

Can Portfolio Trackers Enhance Crypto Investment Decisions?

Portfolio trackers provide a comprehensive view of your investments, showing real-time values and performance across various assets. They help make informed decisions by analyzing individual asset trends and overall portfolio balance.

What Role Do News Aggregators Play In Crypto Trading?

News aggregators compile the latest cryptocurrency news, helping traders stay informed about market-moving events. Quick access to relevant information can be critical for timely decision-making in the volatile crypto market.

Conclusion

Navigating the world of crypto trading requires the right tools. Smart choices in software can make a big difference. They help traders analyze trends and make informed decisions. Reliable crypto trading tools reduce risk and save time. They offer insights that might otherwise be missed.

Remember, a tool is only as good as the trader using it. Always keep learning and stay updated with market changes. Embrace these tools for a more strategic trading approach. Ready to trade smarter? Equip yourself with the best tools and stay ahead in the crypto game.

Your success in crypto trading starts with the right set of tools.

No related posts.