If you run a business in a tough industry, you know how hard it can be to accept credit cards. Many big payment companies turn you away. That’s where we come in at HighRiskPay.com. We focus on high risk merchant accounts. We help you get approved fast and keep your payments running smooth.

Contents

- 1 What Is a High Risk Merchant Account?

- 2 Signs You Need a High Risk Merchant Account

- 3 Industries We Serve at HighRiskPay.com

- 4 Why Choose HighRiskPay.com?

- 5 Our Competitive Rates and Fees

- 6 How to Apply: Simple Steps

- 7 How We Help Prevent Chargebacks

- 8 Tips to Lower Chargebacks in Your Business

- 9 Why We Beat PayPal, Stripe, and Square for High Risk

- 10 Conclusion

- 11 Frequently Asked Questions

What Is a High Risk Merchant Account?

A high risk merchant account is a special type of account for businesses that face more fraud or chargebacks. Banks see these businesses as risky. Normal accounts might get shut down. A high risk account gives you extra protection. It lets you take credit cards without constant worry.

At HighRiskPay.com, we make these accounts easy to get. You can accept all major cards, plus ACH and eChecks.

Signs You Need a High Risk Merchant Account

Not sure if your business counts as high risk? Here are common signs:

- You sell online only, with no physical store.

- Your industry has high chargeback rates, like travel or subscriptions.

- You have bad credit or past payment issues.

- You sell products that are regulated, like CBD or nutraceuticals.

- Your sales volume is high or grows fast.

If any of these fit you, a standard provider like PayPal, Stripe, or Square might reject you or close your account later.

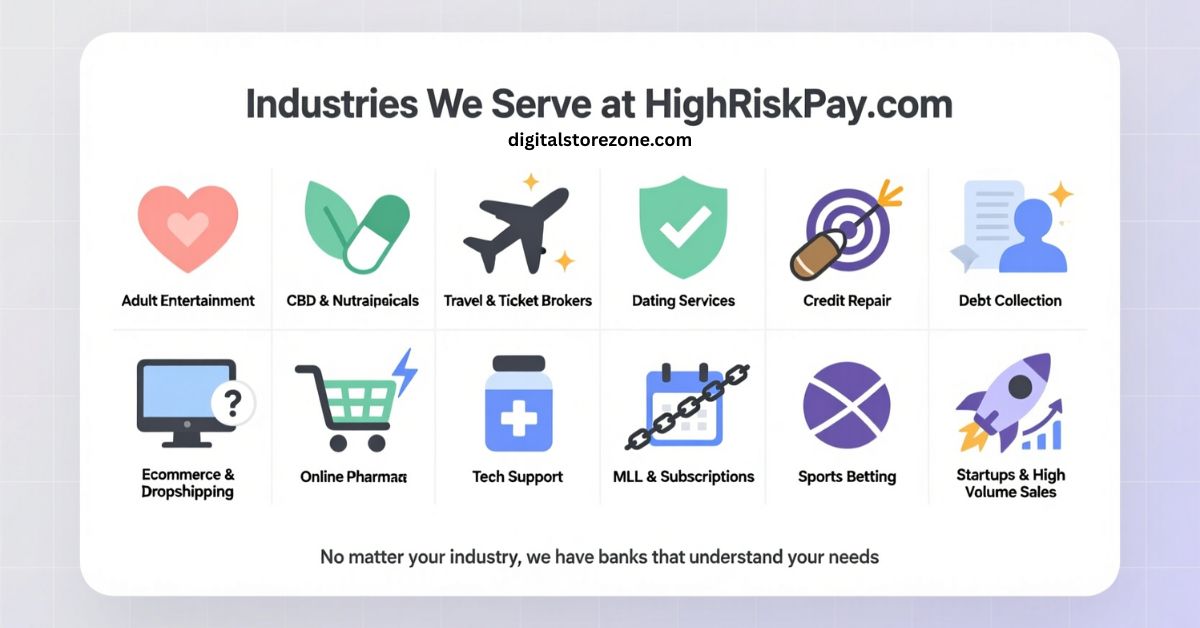

Industries We Serve at HighRiskPay.com

We work with many high risk businesses. Here are some we help every day:

- Adult entertainment

- CBD and nutraceuticals

- Travel and ticket brokers

- Dating services

- Firearms and ammo

- Credit repair

- Debt collection

- Ecommerce and dropshipping

- Online pharmacy

- Tech support

- MLM and subscriptions

- Sports betting

- Startups and high volume sales

No matter your industry, we have banks that understand your needs.

Why Choose HighRiskPay.com?

We stand out for good reasons. Here’s what you get with us:

- 99% approval rate – even with bad credit.

- Fast approval, often in 24 hours.

- No setup fees or application fees.

- No long contracts.

- Next-day funding available.

- Tools to fight fraud and chargebacks.

- Friendly support team ready to help.

Customers rate us 4.7 out of 5 on Trustpilot from over 55 reviews. One said: “Working with High Risk Pay has been amazing! The team quickly helped my business get approved for credit card and ACH payments.”

Our Competitive Rates and Fees

We keep costs low and clear. No hidden charges. Here is a simple breakdown of our rates:

| Business Type | Rate | Per Transaction | Monthly Fee |

|---|---|---|---|

| Retail (Good Credit, Swipe) | 1.79% | $0.25 | $9.95 |

| Internet/Mail (Good Credit) | 2.19% | $0.25 | $9.95 |

| Retail (Bad Credit) | 2.49% | $0.25 | $9.95 |

| High Risk/Internet (Bad Credit) | 2.95% | $0.25 | $9.95 |

| Adult Merchants | 2.95% | $0.50 | $9.95 |

How to Apply: Simple Steps

Getting started is easy. Follow these steps:

- Fill out our short online form. It takes just minutes.

- Send basic docs like ID, business info, and bank statements.

- We review fast and match you with the right bank.

- Get approved and start accepting payments.

We handle most of the work for you.

How We Help Prevent Chargebacks

Chargebacks hurt your business. In 2025, average chargeback rates hit about 0.65% across all sales. But in high risk industries, they can go much higher – sometimes over 1%.

We give you tools to fight back:

- Fraud detection systems.

- Chargeback alerts and help to respond.

- Tips to lower disputes.

These keep your account safe and your money in your pocket.

Tips to Lower Chargebacks in Your Business

Want fewer chargebacks? Try these simple steps:

- Describe products clearly on your site.

- Offer good customer service.

- Use clear billing names on statements.

- Confirm orders with emails or calls when needed.

- Keep records of all sales.

Small changes make a big difference.

Why We Beat PayPal, Stripe, and Square for High Risk

Those big names often say no to high risk businesses. They shut accounts without warning if chargebacks rise. We specialize in high risk. We stick with you and provide the tools you need to stay open.

Conclusion

Finding a reliable high risk merchant account doesn’t have to be stressful. HighRiskPay.com gives you fast approvals, competitive rates, and expert support built for tough industries. Whether you run a CBD, adult, travel, or online business, you can accept payments confidently and focus on growth. Apply today and keep your business moving forward without payment disruptions.

Frequently Asked Questions

Do you accept businesses with bad credit? Yes. Bad credit is fine. We approve 99% of applications.

How fast can I get approved? Many get approved in 24 hours. Some even faster.

Are there setup fees? No. Zero setup or application fees.

What payment types can I accept? All major credit cards, ACH, eChecks.

Do you help with chargebacks? Yes. We offer alerts, prevention tools, and support.

Is there a contract? No long contracts. You can leave anytime.

What industries do you not serve? We serve most high risk types. Ask us about yours.

Ready to get your high risk merchant account at HighRiskPay.com? We make it simple and fast. Start today and focus on growing your business.