Are you confused about loans? Do you want to fix your credit score? Or maybe you need help with debt? TraceLoans.com is here to help. It is a free website full of easy-to-read guides and tips. No sales. No bias. Just facts to help you make smart money choices.

This guide tells you everything about TraceLoans.com. We cover what it is, what you can find there, and how it can help you.

Contents

- 1 What Is TraceLoans.com?

- 2 Why People Use TraceLoans.com

- 3 Main Topics and Guides on TraceLoans.com

- 4 How to Use TraceLoans.com

- 5 Step-by-Step Tips from TraceLoans.com Guides

- 6 Pros and Cons of TraceLoans.com

- 7 Is TraceLoans.com Legit and Safe?

- 8 Better Options If You Need More

- 9 Frequently Asked Questions (FAQs)

- 10 Conclusion

What Is TraceLoans.com?

TraceLoans.com is an online resource for loan and credit information. It gives guides on many types of loans. The site focuses on clear advice for borrowers.

The team behind it wants to help you avoid bad deals. They stay neutral. They do not work with lenders. This means the info is honest.

The site started as a way to explain loans in simple words. Now in 2026, it has many new articles on current money topics.

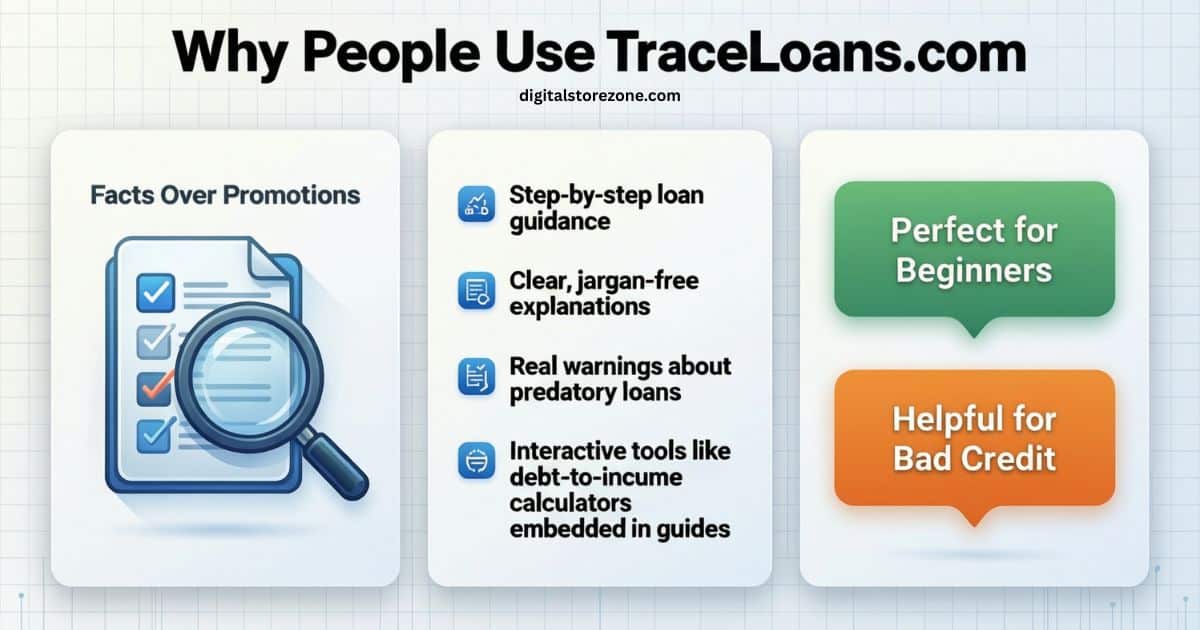

Why People Use TraceLoans.com

Many sites push products. TraceLoans.com does not. It gives facts only.

You get:

- Step-by-step tips

- Clear explanations

- Warnings about bad loans

- Tools like debt-to-income calculators (in their guides)

It is good for beginners. It is also good for people with bad credit.

Main Topics and Guides on TraceLoans.com

The site has sections for different needs. Here are the main ones:

- Personal Loans — Help for sudden costs, basics, scams to avoid, credit tips.

- Mortgage Loans — Fixed rates, emergency funding, rate changes.

- Student Loans — Key facts, refinancing, payoff plans.

- Auto Loans — Pre-approval, payoff early, gig worker tips.

- Business Loans — Government help, fintech options, no-revenue loans.

- Bad Credit Loans — Second-chance tips, avoid predators, credit union ideas.

- Credit Scores — How scores work, ways to improve, building from zero.

- Debt Consolidation — Use loans to pay off debt, pros and cons.

- Vocabulary Hub — Explains terms like APR, HELOC, LTV ratio.

Each section has many articles. They are short and easy.

New in 2026: Recent posts cover gig economy auto loans, pet care financing with bad credit, and spotting predatory lenders.

How to Use TraceLoans.com

It is very easy.

- Go to the site.

- Look at categories on the home page.

- Click what you need (like “Bad Credit Loans”).

- Read the articles.

- Use any calculators they mention.

No sign-up needed. No forms to fill.

Step-by-Step Tips from TraceLoans.com Guides

Here are some key tips they share:

- Check your credit score first.

- Know your debt-to-income ratio (they show how to calculate it).

- Avoid loans with hidden fees.

- Ask lenders good questions.

- For bad credit: Try credit unions or asset-based loans.

These steps help you get better rates.

Pros and Cons of TraceLoans.com

Pros:

- Free to use.

- No bias or ads pushing products.

- Simple words and short articles.

- Covers many loan types.

- Updated often (new posts in 2026).

Cons:

- Does not give loans (info only).

- No personal help (like chat).

- You must read a lot to find answers.

Is TraceLoans.com Legit and Safe?

Yes. It is a real education site. It does not ask for personal info. It does not sell data. The disclaimer says it is for info only. Always check with a pro for big money decisions.

Many users like it for clear facts.

Better Options If You Need More

If you want to apply for loans, look at bank sites or other comparison tools. For more reviews, check trusted finance blogs.

TraceLoans.com is best for learning first.

How TraceLoans.com Helps with Bad Credit in 2026

Bad credit is hard. The site has guides on:

- Avoiding bad lenders.

- Using credit unions.

- Fixing your score fast.

- Options like asset loans.

They warn about high fees.

Tips to Choose the Right Loan

- Compare rates.

- Read the full terms.

- Check your budget.

- Start small if new to loans.

Future of Loan Advice Sites

In 2026, sites like this grow. More people want honest info. TraceLoans.com adds new tools and posts often.

Frequently Asked Questions (FAQs)

What is TraceLoans.com? It is a free site with guides on loans, credit, and debt. No lending.

Does TraceLoans.com give loans? No. It gives advice only.

Is TraceLoans.com safe? Yes. No personal data needed.

Can I improve my credit score with TraceLoans.com? Yes. They have tips and steps to build or fix your score.

What loans does TraceLoans.com cover? Personal, mortgage, student, auto, business, bad credit, and more.

Is the info up to date? Yes. New articles come out often, even in 2026.

Who should use TraceLoans.com? Anyone who wants to learn about loans without pressure.

Conclusion

TraceLoans.com stands out in 2026 as a clean, free, and truly unbiased resource for anyone confused about loans, credit repair, or debt options. With simple language, up-to-date guides on personal loans, bad credit solutions, mortgages, student debt, and more — plus clear warnings about scams and predatory lenders — it helps you learn smart money decisions before you borrow. If you want honest facts without sales pressure or hidden ads, TraceLoans.com is one of the most helpful starting points available right now.